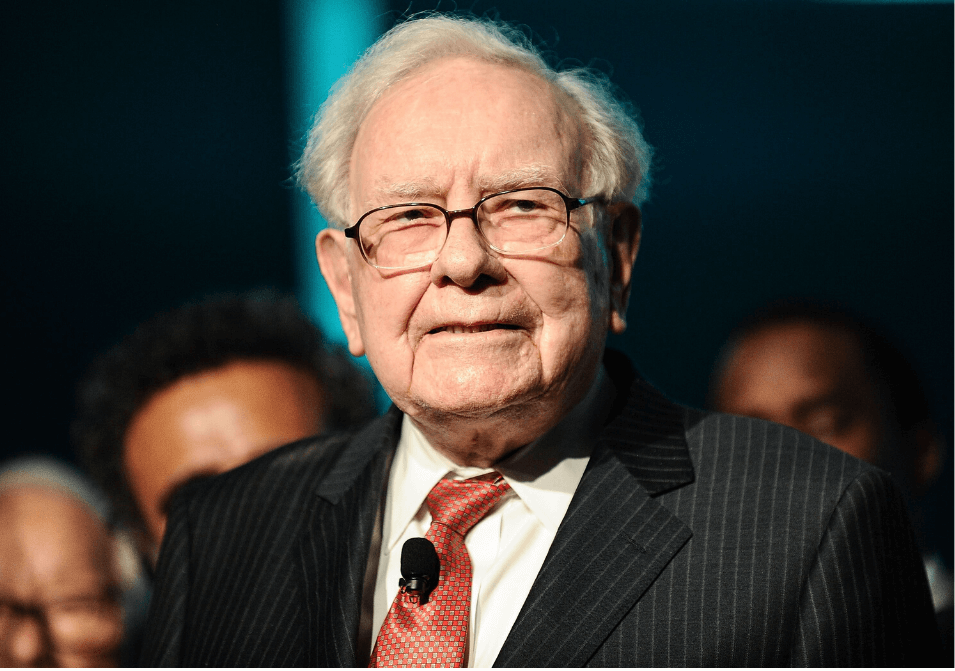

Today, we are here to come with Top 5 Investment Tips by Warren Buffet to become rich fast.

IPO investments have turned out to be more fruitful than the stock investments in the secondary market in most of the cases. But that does not mean that investing in the secondary market is not good at all. Investments are always rewarding, and the rate of reward only depends on the amount of time the investment has been held by the investor. IPO investments, which are also a type of high yielding investments in today’s time, are a type of weapon, which can be used to gain huge returns on a minimum amount of investment.

“Every investor, whether it’s a small investor or a large investor, should always keep the tips and teachings of Warren Buffet in mind, before going for investment because his experience as one of the richest and trusted investors of the world has a lot of knowledge to offer to future investors.”

– Well Said by Vedant Goel, Founder of IPO Corner

The above lines spoken by the experts of www.ipocorner.in are obviously true! Warren Buffet, who is also known as the ‘Oracle of Omaha,’ is one of the best and richest investors in the world history. Most of the investors think that he follows a different investment philosophy, and this is the reason why he is counted as one of the best successful investors.

But the truth is that there is no special investing philosophy which is followed by him. Warren Buffet only follows some golden rules which have made him a successful investor.

Top 5 Investment Tips by Warren Buffet

As an investor, you should know the following investment tips, which are followed and suggested by Warren Buffet to make your investment gains huge and become rich faster.

Buy and Hold your Investments

Warren Buffet believes that if an investor is not willing to own a stock for a long time, for example, 10 years, then it’s useless to own it for even 10 minutes. He gave this statement in one of his interviews. Following this technique, i.e., holding an investment for a long period of time, can turn a minimum amount of investment into a huge financial gain. Investors can earn the most from their investment by just buying and holding their investments.

Related Blog: Impact of COVID19 on Indian Startups to defer IPO Plans

Reinvest your Profits

Most of the investors try to spend their first or initial profits from their investments. But, an investor should instead proceed to reinvest the profits. Warren Buffet follows this investment philosophy, which helps him and his investments to grow more. Investors should try to grow their money rather than making an onetime investment and spending the profits. The more you invest in your profits, the more you can grow financially. A stable investment plan is needed. You can also divide your initial profits into two parts, out of which the minimum part can be used for spending, and the maximum part of your profit should be reinvested again.

When others are Greedy, You have to be Fearful

Warren Buffet always follows this investment tip during his investment decisions. He suggests that when other investors are greedy, you should be fearful, and when other investors are fearful, you should be greedy. An investor should always have enough faith to take any related investment decision and walk out of the crowd. For example, when other investors are buying a particular stock, you should avoid buying it because it becomes overvalued. It is always suggested that you do not buy those stocks which are already overvalued. You should do vice versa, which others are doing.

Go for Undervalued Shares

As per Warren Buffet, investors should go for buying stocks that are undervalued. This is because undervalued stocks are those stocks which are having the huge capacity to return high on investment, but these stocks remain out of the portfolio of the investors. Undervalued stocks are the stocks for those companies, which are performing best in terms of business and are present in the market for years, but not many investors have looked on it. You should conduct proper research and pick the stocks of those companies to invest. If you buy an undervalued stock, there are always great chances that it will provide you a huge return on your investment amount.

Go for High Dividend Payouts

Warren Buffet always looks dividends as healthy. As an investor, he trusts that a good company must have an inventive dividend payout ratio. As an investor, you must always buy the shares of those companies, which pays good dividends to its shareholders. The major reason behind it is that when a company pays a high dividend payout every year, it can cover the volatility risk of the investment. Therefore, when a company pays a high dividend, you will be highly benefitted as an investor in that company. The dividend is the part of the company’s profit, which is paid to the shareholders at a time period, i.e., annually, half-yearly, or quarterly.

Conclusion

If you want to invest in the IPOs for not only earning huge profits but also want to use the weapon of investment to make yourself rich smartly, then you must follow the above given investment tips from Warren Buffet. Always remember that these are not only investment tips, but these are smart ways to apply for the investors in their investments, which can fetch them, a successful gain, and high return every time. If Warrant Buffet has achieved a renowned success, why can’t you? Never forget these investment tips and always use them while going for any investment. Happy Investing!

Follow WEXT.in Community on Google News at https://bit.ly/WEXTGoogleNews for more interesting articles on Investment, Business, Indian Startups.